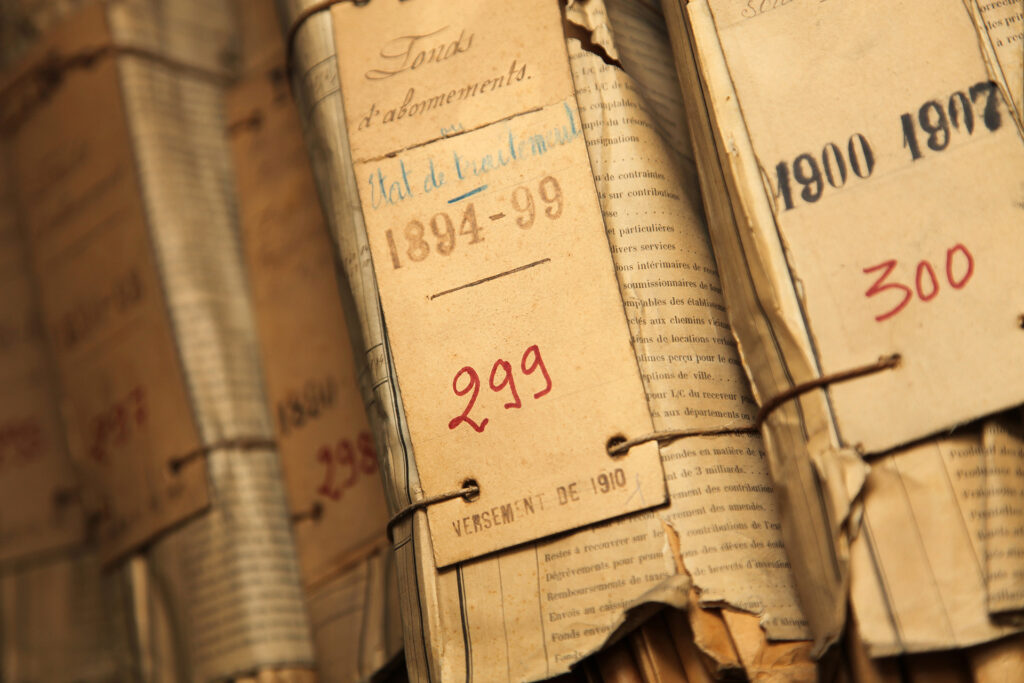

Retention periods for long-term archiving

The most important information about the legal regulations

“Retention period is the period of time within which documents subject to retention must be archived in an orderly manner.” That’s what Wikipedia says. What are documents subject to retention requirements in the first place and how long must they be archived? In this article, we answer the most important questions about the statutory retention periods for business documents.

What does retention mean?

In business, documents must be retained because they serve as evidence. This is regulated by law in the Commercial Code (§ 238 HGB and § 257 HGB) and in the Fiscal Code (§ 147 AO). In part, the regulations in the HGB and in the AO are congruent. Those who do not comply with them may be subject to fines and tax disadvantages.

Who must observe retention periods?

In principle, anyone who is obliged to keep books and records under tax or commercial law is required to keep records. These are in detail:

- Business owners of sole proprietorships

- Shareholders in the case of a civil-law partnership or general partnership

- the personally liable partners and the partners appointed to manage a KG (limited partnership)

- Managing directors of a GmbH

How long must business documents be kept?

The periods vary depending on the type of documents. There are regulations for periods of 2 years (apply to non-entrepreneurs*), 6 years, 10 years and indefinitely (e.g. real estate documents).

Rule of thumb: All documents that are also necessary for accounting are subject to the 10-year retention period. Small business owners and self-employed persons who do not have any employees are exempt from this rule.

The following documents must be kept for 10 years:

- Books and records

- Land register

- General ledger

- subsidiary ledgers

- financial statements

- Commercial or business letters

- the confirmation of receipt for online orders (cf. Section 312i (1) Sentence 1 No. 1 of the German Civil Code (BGB) and the order confirmation,

- the delivery bill and the consignment note,

- information about the goods shipped,

- any correspondence concerning the execution of the contract

- accounting documents

- invoices or copies of invoices

- delivery notes

- order confirmation

- records of inventory of goods, etc.

In general, all business documents that serve as the basis for accounting/taxation should be kept for 10 years. For all other documents that must be retained, such as offers, order confirmations, business letters, reminders, contracts, the period of 6 years applies accordingly – in case of doubt, it is better to choose the 10-year period. By the way: Correspondence that has not led to the conclusion of a transaction is not subject to the retention obligation.

Start and end of the retention period

The retention period begins at the close of the calendar year in which the document was prepared. If your tax advisor completed your financial statements for fiscal year 2019 in December 2020, then the retention period for that particular set of financial statements begins at the end of 2020 and ends in 2030.

In what form must the documents be kept?

The law prescribes different forms for the various documents:

- Annual financial statements must be kept in the original in accordance with Section 147 (2) AO.

- Commercial and business letters must be kept in such a way that they correspond visually to the original (pictorial reproduction).

- Accounting documents must also be kept in such a way that they correspond visually with the original.

- For all other documents, it is sufficient if their content corresponds to the original (content reproduction)

1. Storage in the original

If paper records must be kept in the original, it must be ensured that this is done in a “secured” and orderly” manner. In the case of thermal paper, for example, copies must be made in good time and stapled to them, as the writing fades over time. Documents must also be protected from fire, water and moisture in particular.

2. Pictorial reproduction

The important thing in image reproduction for commercial and business documents is the faithful transfer of the image to the storage medium. A different size format can be used.

3. Content reproduction

During storage, the content of the document must not be changed. Information must always be transferred completely and correctly.

4. Electronic invoices

A special rule applies to electronic invoices: they must be stored in the form in which they were received. It is also important that the storage medium on which the invoice is kept does not allow any subsequent changes.

Criteria for correct retention

Business records are properly retained when they meet the following criteria:

- Retrievable at any time

- Unchangeable (originals!)

- Complete

- Correctly legible

- Traceable

- Machine analyzable

Long-term archiving made easy

All the legal regulations and criteria are daunting at first glance. But long-term archiving is less time-consuming than some might think. After all, the right software solution takes care of a large part of the tasks required to transfer documents to the archive.

Conversion is usually the first step in archiving. After all, countless documents arrive at the company in different file formats, which must first be standardized so that they can be saved as PDF/A, for example, the standard format for long-term archiving. Ideally, the original file and the converted standard format file (PDF/A) should be saved simultaneously.

With webPDF, for example, more than 100 different file formats can be converted to PDF and further processed. This reduces countless file formats to a single format within the company. This simplifies the further process steps for archiving immensely.